A lien release is one of the vital steps in the mechanics lien process. It is equivalent to a cancellation of an existing mechanics lien. Releasing a lien is typically the final step in filing a mechanics lien, provided that all outstanding payments have been settled.

When releasing a mechanics lien, two things are implied: i) a mechanics lien has already been recorded against a property, and ii) all invoices that are subject to that mechanics lien have been subsequently paid off.

Releasing a lien, therefore, declares that the outstanding debts claimed under a mechanics lien have been cleared, and so this mechanics lien may be discharged from the property’s public records.

There are a few reasons why releasing a lien is an essential step in completing the mechanics lien process:

Property owners are the key stakeholders who want to have a mechanics lien released from their properties’ records. Having a mechanics lien attached to a property raises a red flag to potential buyers and financiers, so property owners are keen in discharging a mechanics lien.

A lien release is, therefore, often a condition for payment during negotiations. Property owners will often require the construction party who filed a mechanics lien to release this lien soon after the payment is settled.

When you receive the full payment that you are claiming in your mechanics lien, you are expected to release the satisfied lien. Failing to do so may cause you to pay hefty fines or pay back the attorney fees that were incurred by the property owner.

The specific consequences vary per state, but it is otherwise considered best practice to release a lien as soon as you receive the payment. If the property owners have done their due diligence by paying their debt, you must also do your duty and cancel the mechanics lien attached to their property’s public files.

A lien release is one of the most convenient ways to cancel a mechanics lien against a property. Other options include asking for a court order or filing a foreclosure lawsuit, both of which are more costly and tedious.

The specific timing requirements in releasing a mechanics lien depend on multiple factors. Some states require a mechanics lien to be released soon after payment has been settled, usually between 10 to 60 days upon lien satisfaction.

There are also states that require the filing of a lien release after a written request from the property owner has been received. You are advised to familiarize yourself with the specific mechanics lien process in the state in which you are working just so you don’t miss any important deadlines.

Generally speaking, you should only file a lien release once payment has been made – no ifs, no buts.

However, actual payment negotiations may not be as straightforward. Property owners may require you to release a mechanics lien before they pay you up. They are simply taking precaution – they may be wary of settling outstanding debts with no assurance that the mechanics lien will be subsequently canceled from their properties’ records.

In this case, you just have to keep in mind that once you release a lien, you will have a very difficult time recording it back.

Property owners can seek legal remedies to prompt their contractors and materialmen to file a lien release as long as they can prove that the lien has been satisfied. You, on the other hand, will have no other recourse once you have released a lien but did not end up getting paid.

Which states require you to file a lien release?

The following states require its construction participants to file a lien release:

| Alabama | Arizona | Arkansas |

| Colorado | Illinois | Iowa |

| Kentucky | Louisiana | Maine |

| Maryland | Michigan | Mississippi |

| Missouri | Montana | Nevada |

| New Hampshire | New Jersey | Ohio |

| Oklahoma | Oregon | South Carolina |

| South Dakota | Tennessee | Texas |

| Utah | Washington State | West Virginia |

| Wisconsin | Wyoming |

You are expected to file a lien release in the states above after you have verified that the payment is on hand.

Some states like Maryland, South Dakota, and Wisconsin do not impose a specific time frame for filing a lien release. However, you are still expected to discharge your mechanics liens in these states upon satisfaction of the lien.

The deadlines are more specific in states like Missouri, Oregon, and Texas in which you must release the lien within 10 days of lien satisfaction. States like Kentucky, New Jersey, and Ohio have a slightly longer deadline of 30 days after receiving payment.

Some deadlines also depend on the date on which you receive a written request from the property owner. In Colorado, Illinois, and Utah, you must file a lien release within 10 days upon receiving a formal written request from the owner to discharge your lien.

Regardless of the deadlines, it is still best practice to file a lien release as soon as you receive your payment. Preparing your lien release form in advance and filing it as soon as payment is cleared will help you avoid incurring additional expenses in potential fines and penalties.

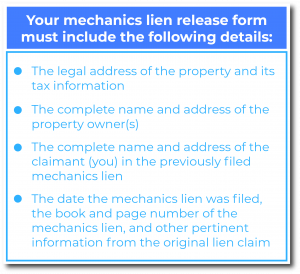

Your mechanics lien release form must include the following details:

Note that most of the details that you need can be found in the mechanics lien that you initially filed.

These are the steps to filing a lien release and some useful tips.

A lien release document must be notarized for it to be considered valid.

You need two copies of your lien release form: one is kept in the recorder’s office while the other is mailed back to you once the lien release has been officially recorded.

You may only file a lien release in the same location where your mechanics lien was recorded. There are no workarounds to this requirement.

There are, however, multiple options on how you can record your lien release. You can file a lien release by sending your documents via hand delivery, certified mail, or overnight mail. The documents must come with the money order that covers the lien release fees.

You may also record your lien release via the Handle app. Handle takes care of all things related to mechanics liens, from ensuring that your pre-lien notices are sent on time via certified mail to filing your lien releases accordingly.

Once a lien release has been recorded in the clerk’s office, you will soon receive a second copy of your lien release document. This document should be marked “recorded” or “filed.”

You must make a copy of this “filed” form and serve it on the property owner and other stakeholders to prove that you have successfully canceled the mechanics lien.

Most states do not have clear provisions on allowing or disallowing a partial release of lien, which is basically the cancellation of a lien but only for part of the original amount claimed.

Texas is one of the few states in which a partial release of lien is accepted. In the case of Texas, a partial release of lien is not only accepted but is also required — you must file a partial lien release in Texas within 10 days of receiving partial payment.

Most states, however, do not have clear and specific partial lien release rules. States like Utah and Tennessee do not have specific provisions on whether a partial release of lien is enforceable or not. Ohio also only specifies a release of lien provision for the satisfaction of the original lien claim amount.

You are advised to familiarize yourselves with the rules and regulations of the state in which you are working in

A lien release is often confused with a lien waiver, but these two are not the same documents. A lien release is filed to cancel an already existing mechanics lien. A lien waiver, on the other hand, is issued to waive a construction party’s right to file a mechanics lien.

Filing a lien release, therefore, means that a payment dispute has already occurred but was eventually settled. This is way different from serving a lien waiver, which shows that a mechanics lien will not be part of the equation should a payment dispute happen.